Magnificent Seven Digest: Latest Updates and Market Movements🔍

What happened to the Magnificent Seven in 8/17 - 8/23

Greetings!

This email is a pilot version addressed to Vest Way subscribers.

In this edition, we dive into the latest updates from the "Magnificent Seven" of tech. From breakthroughs to challenges, discover what's shaping the tech world this week.

Let’s dive into insights from Bloomberg!

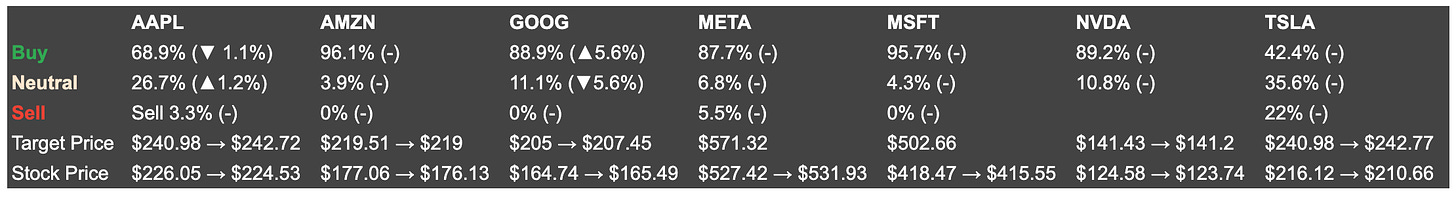

The Analyst Recommendation & Stock Price

How it changed during last week:

Uplifting Information!

🔧Apple Moves Production to India with New Product Launches

Apple is set to assemble its most expensive iPhone Pro and Pro Max models in India for the first time, aiming to tap into the local market and reduce reliance on China.

This strategic move aligns with India's "Make in India" campaign, fostering local job creation and streamlining supply chains for faster deliveries.

Source: Bloomberg Intelligence, Bloomberg News Story

Make in India Campaign is a campaign operated by the Indian government to make India into a global manufacturing hub. The Indian government provides financial incentives to the companies that produce their products in India.

🔝Nvidia Soars with AI Investments

Nvidia is set to reach record highs due to a surge in AI investments, boosting its stock value and investor confidence. From August 9 to August 19, Nvidia experienced a steady rise from $104.75 to $130. The record high for Nvidia, which is $135.58, is within sight. Analysts predict sustained growth fueled by strong AI spending trends. Nvidia's advancements in machine learning and data processing are expected to set industry benchmarks, enhancing its competitive edge. The company's strategic focus on AI positions it well to capitalize on emerging tech trends and maintain its upward market trajectory.

Source: Bloomberg Intelligence, Bloomberg News Story

Market Trajectory refers to the direction and pace at which a market or a specific industry's market conditions, such as size, demand, and growth, are evolving over a period of time. Understanding market trends helps investors make informed decisions about asset allocation, timing, and risk management, while also shaping strategies for income generation and long-term planning.

Asset Allocation means spreading your investments across different types of assets like stocks, bonds, and cash to balance risk and potential returns. This approach helps reduce the impact if one asset doesn't perform well, aiming for more consistent overall growth.

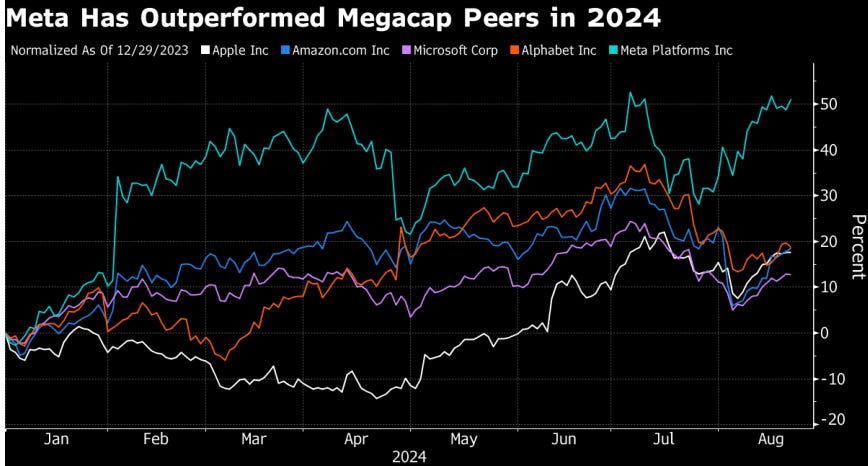

🚀Meta's AI Vision Boosts Shares

Meta, the parent company of Facebook and Instagram, has experienced significant growth recently, with shares increasing by 13% this month. CEO Mark Zuckerberg's successful promotion of AI technology's benefits for digital advertising has driven this surge. By enhancing their investment in AI, Meta aims to help advertisers target users more effectively and boost platform engagement. Consequently, their stock price has reached a new all-time high of $544.23, marking an exciting period for the company.

Source: Bloomberg News Story

🤝Microsoft’s Steady Growth and Exciting Partnerships

Microsoft is making headlines for its stable growth and strategic partnerships. By teaming up with the London Stock Exchange Group (LSE), Microsoft aims to transform data and analytics services through its cloud platform, enhancing customer experiences and driving revenue growth. With low stock volatility and high profitability, Microsoft continues to stand out in the tech industry, showcasing its commitment to innovation and solid market position.

Source: Bloomberg Intelligence

Volatility measures how much and how quickly the price of an asset, like a stock or bond, changes over time. High volatility means prices move up and down a lot, and low volatility means prices are more stable.

Potentially Unwelcome News

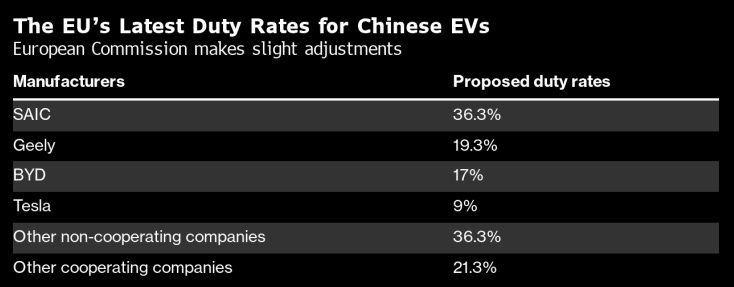

🚨Tesla Faces Multiple Hurdles

Tesla is currently grappling with a 9% tariff on cars imported from China to the EU, which could significantly impact its pricing strategies and demand in Europe. This tariff is part of the EU's broader investigation into Chinese electric vehicles, aiming to counter subsidies provided by Beijing.

Additionally, the NTSB(National Transportation Safety Board) has initiated a safety investigation into an August 19 crash involving a Tesla electric-powered truck tractor in California. This probe, conducted in coordination with the California Highway Patrol, could add to concerns about Tesla's safety protocols.

Source: Bloomberg News Story, Bloomberg First Word

Tariff is a tax that a government places on imported or exported goods. It aims to protect local businesses, raise government revenue, and regulate international trade by making foreign products more expensive.

Subsidies are financial assistance provided by the government to businesses, organizations, or individuals to support and promote economic activities. These can lower production costs, encourage growth, and make goods or services more affordable for consumers.

August 19 crash occurred on Interstate 80 near Emigrant Gap. Tesla electric powered truck tractor went off the road and crashed into some trees. No one was injured, but the vehicle caught fire, and the truck’s batteries continued burning for four hours. The NTSB decided to investigate the crash due to its interest in the fire risk associated with lithium-ion batteries.

Information to Check

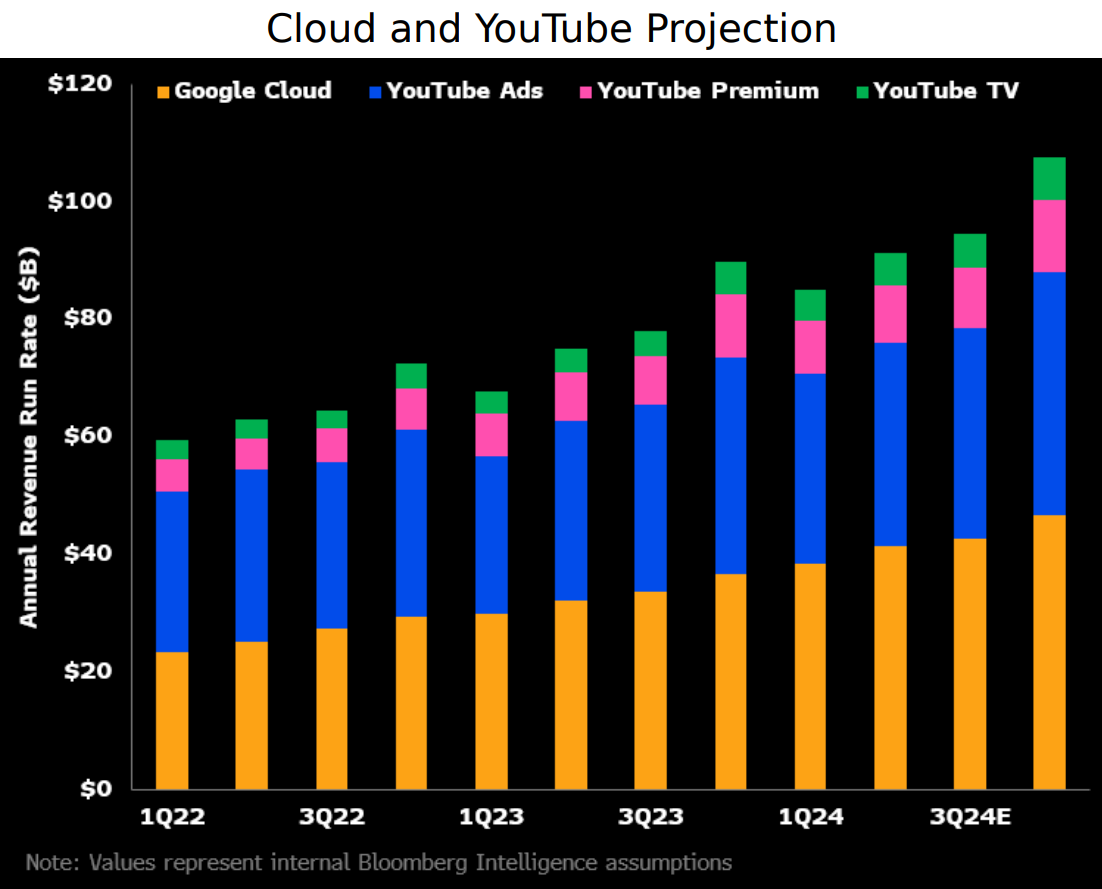

📂Alphabet Faces Stock Dip and AI Ambitions

Alphabet, recently saw its shares drop 6.6% over the past month after insider selling by CEO Sundar Pichai, who sold $3.77 million in shares. This move sparked investor concerns and market fluctuations.

Despite this, Alphabet has launched ambitious AI initiatives to integrate AI across Google services, aiming to transform user interactions with its applications. Analysts predict these initiatives could boost long-term profitability despite short-term volatility. This focus on AI highlights Alphabet's commitment to technological leadership and innovation in the competitive tech landscape.

Source: Bloomberg Intelligence, Bloomberg Opinion, Bloomberg Law, Bloomberg News Story

Inside Selling refers to the sale of a company's stock by individuals who have access to non-public, material information about the company. Investors may interpret insider selling as a lack of confidence in the company's future performance, leading to a decrease in stock price.

Market Fluctuations are the frequent and unpredictable changes in the prices of stocks or other financial instruments, influenced by factors like economic data, investor sentiment, and political events.

🌱Amazon Faces Legal Setback but Eyes Future Growth in Key Sectors

Amazon has been fined $525 million for patent infringements, causing a financial setback and highlighting the complexities of tech patent laws. The court ruled that AWS infringed on patents related to cloud storage technology owned by Kove IO. As a result of this and heavy AI spending, its stock is lagging.

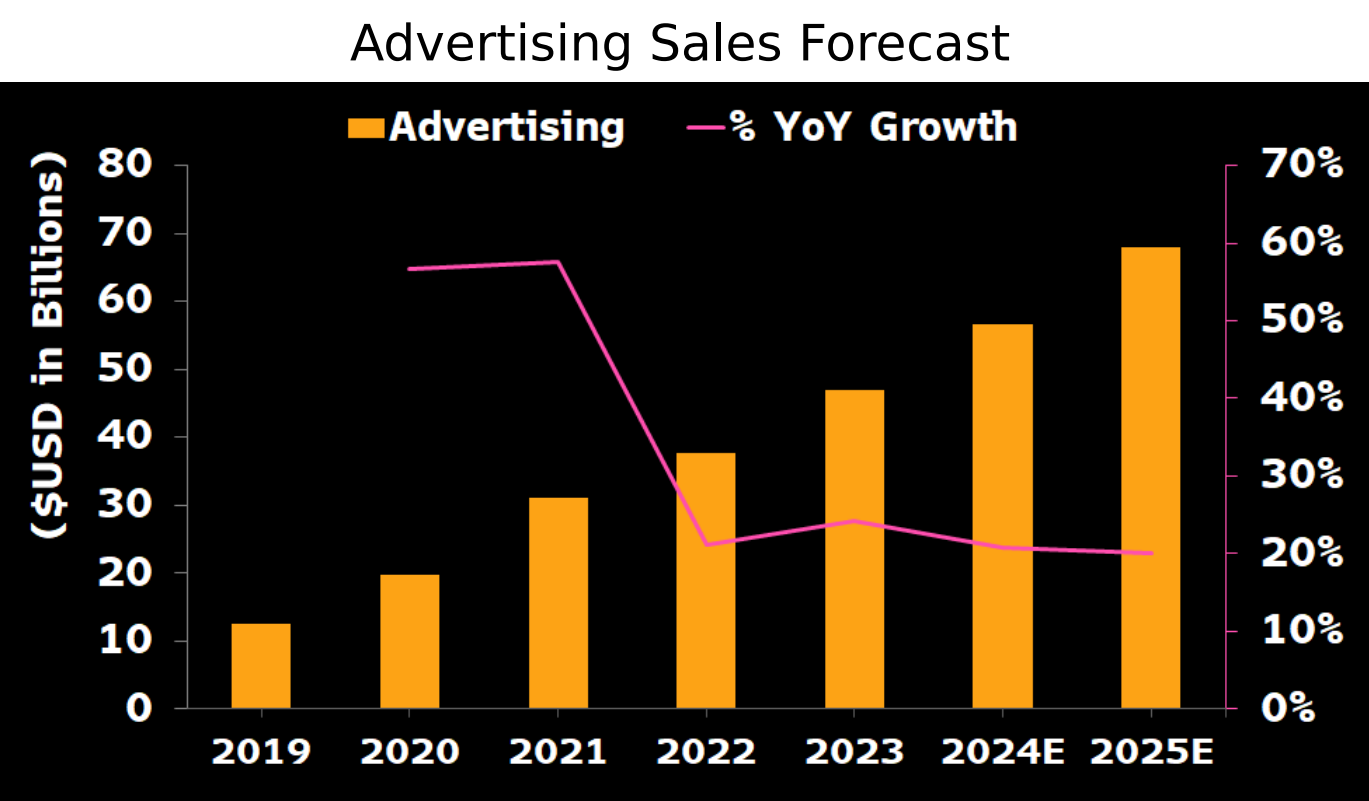

However, Amazon continues to grow in key areas like advertising and cloud services. By leveraging its expansive digital ecosystem and advanced technological infrastructure, Amazon is strategically positioning itself for future success.

Source: Bloomberg Intelligence, Bloomberg Law, Bloomberg News Story

Patent Infringement occurs when someone uses, sells, or makes a patented invention without the permission of the patent holder. This unauthorized use violates the rights granted by the patent and can lead to legal action.

That’s all for today!

If this was useful, share the post to your friends and fellow investors.