Magnificent Seven News: Lawsuits and Expectations🏛️

What happened to the Magnificent Seven in 8/31 - 9/6

This email is a pilot version addressed to Vest Way subscribers.

We dive into the latest updates from the "Magnificent Seven" of tech. From breakthroughs to challenges, discover what's shaping the tech world this week.

This edition covers

Meta’s $0.50 dividend and potential growth

Amazon’s legal victory and growth projections

Microsoft’s AI patent lawsuit

Alphabet’s regulatory challenges and investor caution

Tesla’s FSD launch in China and Europe

Apple’s iPhone 16 sales boost

Nvidia’s DOJ probe

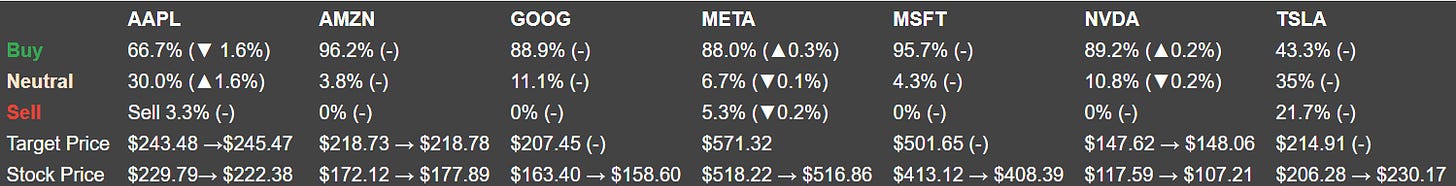

The Analyst Recommendation & Stock Price

How it changed during last week:

Uplifting Information!

💵Meta Maintains $0.50 Quarterly Dividend, Projects Strong Growth

Meta Platforms Inc. has announced that its Class A shares will continue with the regular quarterly cash dividend of 50 cents per share. The dividend will be declared on September 5, with payment on September 26. Bloomberg projects a 0.39% dividend yield, with a three-year dividend growth forecast of 42.60%.

Source: Bloomberg News Story

Class Shares are often used to distinguish different voting rights. For example, Class A might have more voting power than Class B.

Dividend Yield is the annual dividend payment divided by the stock price, expressed as a percentage. If company A’s stock is worth $100 per share and company A provides yearly dividend of $5, the dividend yield of company A’s stock is 5%.

🏆Amazon's Legal Victory and Bright Future

Amazon recently celebrated a notable legal victory by getting a class-action lawsuit over Prime Video user data dismissed. This success reduces some of the legal pressures on the company, allowing it to refocus on its business strategies without the lawsuit to worry about. It’s a significant development that helps maintain its reputation.

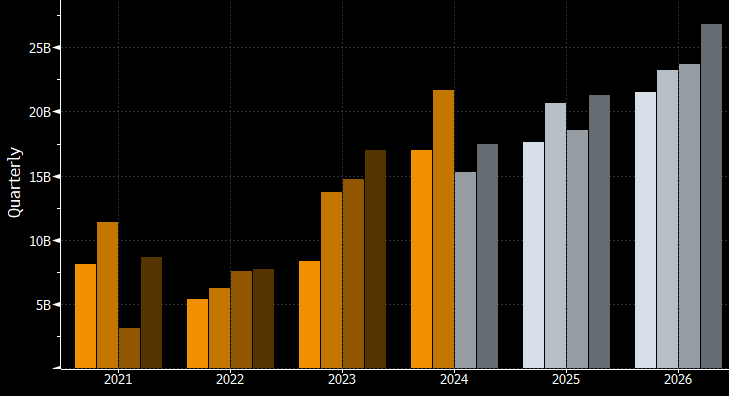

Looking ahead, Amazon's future appears bright. Analysts project that total sales could exceed $730 billion by 2025, primarily driven by robust growth in digital advertising and AWS.

The chart below shows the adjusted net income projected by Bloomberg.

Source: Bloomberg Intelligence, Bloomberg Law

Lawsuit on Prime Video Amazon was sued by customers including Meredith Beagle for viewing histories of Prime Video users without their consent in violation of federal and state privacy laws.

GMV (Growth Merchandise Value) is the total sales value of merchandise sold through a platform over a specific period.

Adjusted Net Income shows a company's regular profitability by removing one-time or unusual items from the net income. This gives a clearer view of how well the core business is performing, helping investors see the true, ongoing earnings of the company.

Potentially Unwelcome News

⚖️Alphabet Faces Regulatory Hurdles and Investor Caution

Alphabet is facing significant challenges. Morgan Stanley has lowered its price target for Alphabet from $205 to $190 due to ongoing antitrust actions. The firm believes that the long-term uncertainty continues to pose a risk. Although Alphabet recently won a lawsuit dismissal related to misleading advertising tech practices, it remains under intense scrutiny from U.S. and European regulators. These regulatory hurdles complicate Alphabet's efforts to diversify its revenue streams, adding uncertainty to its future growth prospects. Investors are cautious, given the long-term implications of these legal battles on Alphabet's business operations.

Source: Bloomberg Law, Bloomberg First Word

Revenue Streams are the various sources from which a business earns money. These can include sales of products or services, licensing fees, and subscription fees.

Information to Check

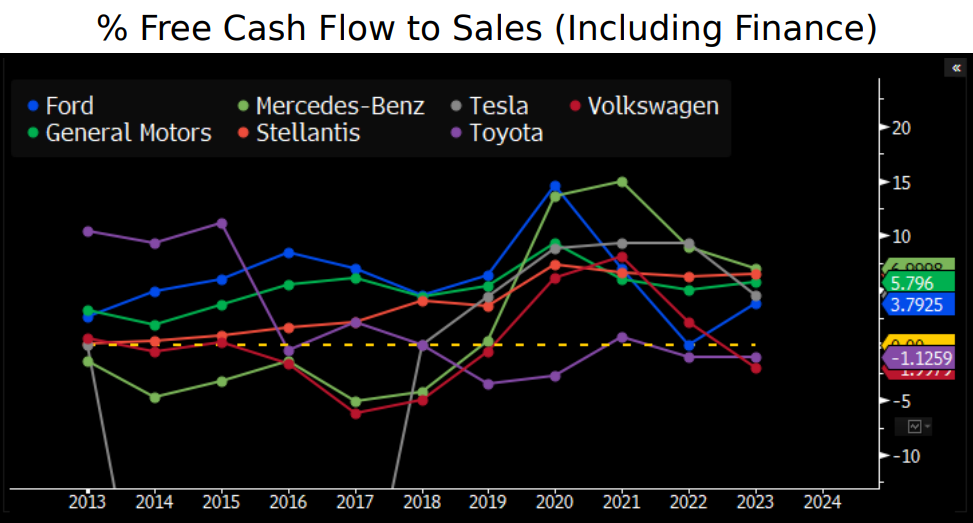

🚗Tesla to Launch FSD in China and Europe Amid Financial and Regulatory Hurdles

Tesla Inc. plans to roll out its Full Self-Driving (FSD) technology in China and Europe early next year, pending regulatory approval. This strategic move aims to strengthen Tesla’s market position amid intense competition from Chinese tech firms. Furthermore, In August, Tesla’s vehicle deliveries in China rose 17% month-over-month to 86,697 unit, though year-to-date shipments have declined by 6%.

Recent reports highlight Tesla's robust financial indicators. Tesla's free cash conversion is mostly in line with global peers, although its EBITDA margin faces headwinds from lower demand and pricing. Analysts remain cautious, assessing how regulatory and market challenges may impact Tesla’s long-term growth.

Source: Bloomberg Intelligence, Bloomberg News Story, Bloomberg First Word

Free Cash Conversion shows how well a company turns its profits into cash after paying its bills and investing in its business. It is calculated by (Free Cash Flow)/(Net Income).

Free Cash Flow is the money a company has left after it pays all its operating expenses and invests in its business.

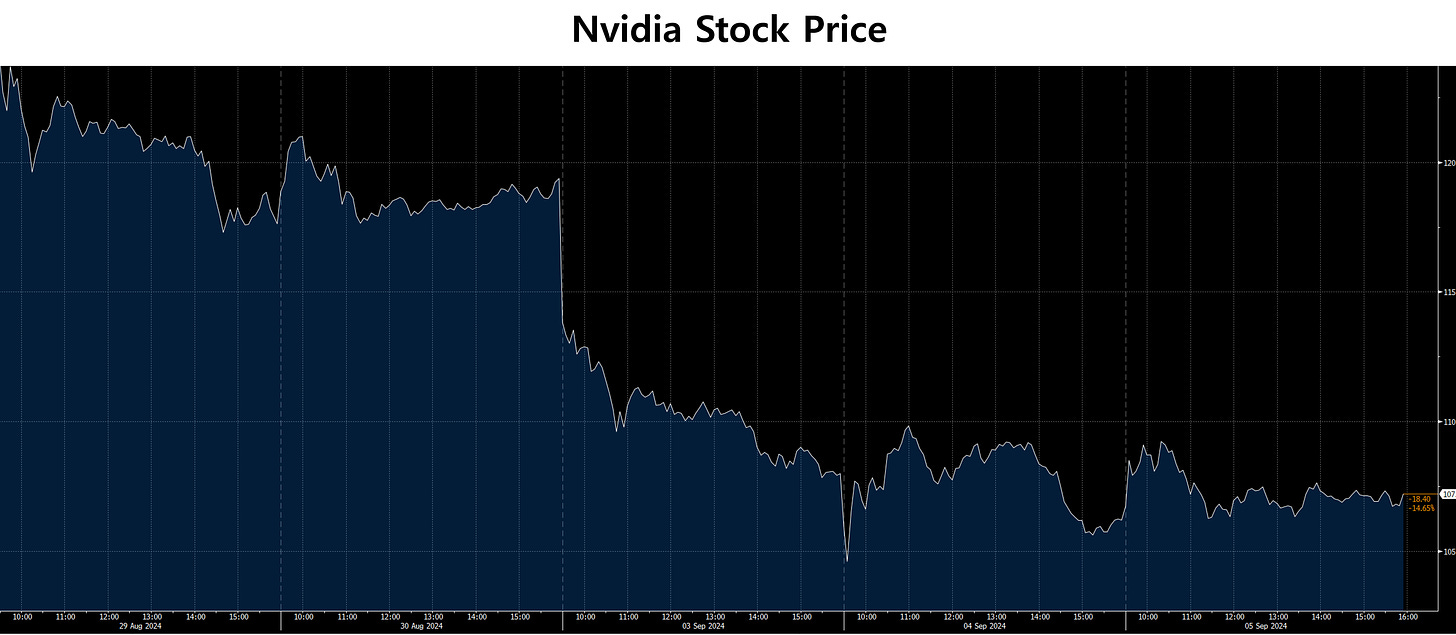

📉Nvidia Grapples with DOJ Probe and Lawsuit Despite Financial Strength

Nvidia Corp. faces challenges including a DOJ antitrust investigation. The DOJ’s probe, questioning Nvidia's business practices, has coincided with a stock drop of 18% since August. Disappointing Q2 earnings and increased regulatory scrutiny are compounding Nvidia's woes.

Despite these issues, Nvidia has denied receiving DOJ subpoenas and maintains strong financial health with robust free cash flow and significant reserves. The company is scaling up AI technology supply and continuing its share buyback plans. Analysts remain cautiously optimistic about Nvidia's potential for sustaining future growth amidst these hurdles.

Source: Bloomberg Intelligence, Bloomberg TV and Video, Bloomberg First Word

A DOJ Antitrust Investigation examines whether a company is engaging in unfair business practices that reduce competition.

Reserves refer to the financial resources that a company accumulates and sets aside for future use. These funds can be used to cover unexpected costs, invest in new projects, or provide a financial cushion during economic uncertainties, helping the company maintain stability and continue its operations and growth initiatives.

Buyback is when a company buys its own shares from the market, reducing the number of shares available. This makes the remaining shares more valuable.

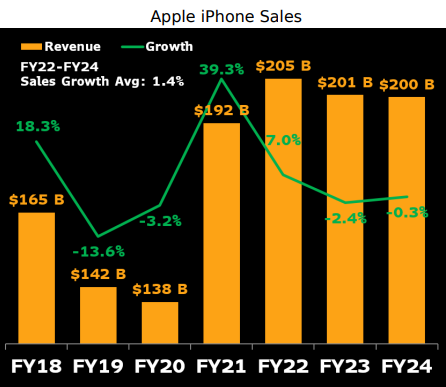

📱Apple's iPhone 16 Expected to Boost 2025 Sales, Despite AI Rollout Challenges

Apple's latest iPhone 16 is expected to slightly boost unit sales for fiscal 2025, driven by users upgrading their older devices. Analysts anticipate a 5% increase in sales. However, the rollout of new AI features may be slower than expected, challenging meeting higher sales expectations in 2026. This release sets the stage for Apple to maintain its market dominance with high-end models like the Pro and Pro Max.

Source: Bloomberg Intelligence

That’s all for today!

If this was useful, share the post to your friends and fellow investors.