[Pilot] Microsoft Boosts Dividends While Apple Faces iPhone Slump📉

What happened to the Magnificent Seven in 9/14 - 9/20

This email is a pilot version addressed to Vest Way subscribers.

We dive into the latest updates from the "Magnificent Seven" of tech. Discover what's shaping the tech world this week, from breakthroughs to challenges.

This edition covers

Microsoft’s enhance of shareholder return

Meta’s breaking through of long-term resistance line

Apple’s slumping iPhone orders and change in financial service

Nvidia’s patent infringement

Alphabet’s Pixel phone and watch release

Tesla and mixed expectations for the EV market

Amazon’s change in employee management`

🔥 Discover more information on our app service: Learn to Earn

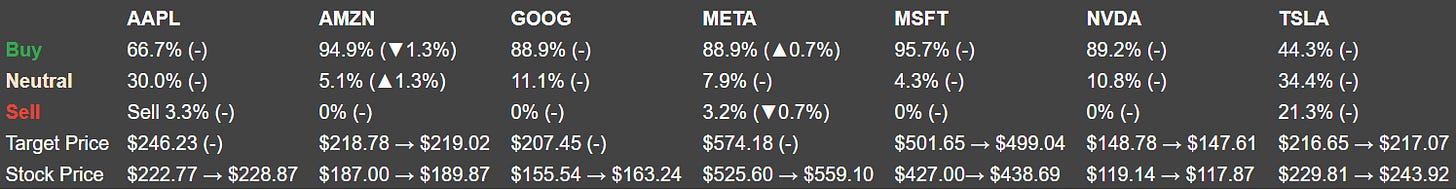

The Analyst Recommendation & Stock Price

How it changed during last week:

Subscribe for free to receive new posts and support my work!

Important News

On September 18, United States Federal Open Market Committee announced the interest rate of 5.00%. It’s a huge 0.5% down from 5.50%, the recent interest rate. It serves as a benchmark for various interest rates in the economy.

Federal interest rate is often used to manage inflation.

When inflation is high, the Fed may raise the interest rate to make borrowing more expensive, which can reduce spending and slow down the economy, thus lowering inflation.

Conversely, when inflation is low, the Fed might lower the rate to encourage borrowing and spending, stimulating economic activity and potentially increasing inflation.

The Fed's interest rate decisions can impact stock prices. Higher rates tend to raise borrowing costs and reduce corporate profits, leading to lower stock prices. Lower interest rates make borrowing cheaper, boosting corporate earnings and stock prices.

An interest rate is the percentage charged by a lender to a borrower for the use of assets, typically expressed annually.

Inflation is the rate at which the general level of prices for goods and services rises over time, leading to a decrease in the purchasing power of money.

Uplifting Information!

💵Microsoft Enhances Shareholder Return

On September 16, Microsoft announced a quarterly dividend increase to $0.83 per share, an 8-cent boost from the previous quarter. Additionally, they approved a new share buyback program worth up to $60 billion. The dividend will be payable on December 12, to shareholders of record by November 21.

Source: Bloomberg News Story

Shareholder Return refers to the financial gains that investors receive from their investment in a company's stock, including dividends, buybacks and any increase in the stock's market value.

Dividends are payments that companies give to their shareholders from their profits. They can be in cash or extra shares. For investors, dividends provide a source of regular income in addition to any gains from the increase in the stock price. This can be especially beneficial for those looking for steady cash flow.

Buyback Program is when a company buys its own shares from the market, reducing the number of shares available. This makes the remaining shares more valuable.

🔝Meta Breaks Barriers, Hits New Stock Market Peak

On September 19, Meta broke through a long-term resistance line to hit record highs in the stock market. Breaking a long-term resistance level means the stock has surpassed a price barrier it struggled with for an extended period. Meta's stock rose as much as 4.4%, reaching over $561. This surge added $55.5 billion to its market cap. The stock has increased by 52% this year and an impressive 76% over the past 12 months.

The following image is the stock price of META and the long-term resistance line estimated by Bloomeberg.

Source: Bloomberg First Word

A Resistance Line is a price level at which a stock consistently experiences selling pressure, preventing it from rising further. It represents a psychological barrier where a large number of sellers are willing to sell their holdings. Breaking through this resistance line can indicate a potential bullish trend as it suggests increased demand.

Potentially Unwelcome News

🤔Slumping iPhone 16 Pro Orders and Credit Card Shifts Hit Apple

According to an analyst report by Ming-Chi Kuo from TF International Securities, Apple's iPhone 16 Pro pre-orders, which began on September 4, have shown weaker-than-expected demand, causing concern for the company. Due to this news, Apple stock slumped about 3% to start Monday trading.

Meanwhile, Apple is also dealing with changes to its credit card program. According to Bloomberg News on September 17, discussions are underway for JPMorgan Chase to take over the program from Goldman Sachs, the current issuer. This transition could impact Apple’s financial services strategy.

Source: Bloomberg News Story

⚖️ Nvidia Confronts Allegations of Patent Infringement

A Bloomberg Intelligence report on September 19 highlighted Nvidia facing serious allegations from Xockets over patent infringement. Xockets contends that Nvidia's acquisition of Mellanox led to the unauthorized use of their DPU technology, boosting Nvidia's GPU market position.

Analysts suggest that while there are financial risks involved, the strength of Xockets' claims may be debatable. The trial is not expected to start until mid-2026, leaving Nvidia with a prolonged period of legal uncertainty.

Source: Bloomberg Intelligence

A Data Processing Unit (DPU) is a special computer chip that helps handle data tasks, such as moving data around and keeping it secure. It takes some of the workload off the main processor, making computers and data centers work more efficiently.

A Graphics Processing Unit (GPU) is a specialized chip designed to quickly render images and videos. It's also used for tasks like AI and scientific calculations because it can process many operations simultaneously.

Information to Check

⌚Google Unveils Pixel 9 Pro and Pixel Watch 3

Google released the Google Pixel 9 Pro and the Pixel Watch 3 each on September 4 and September 10, showcasing its strong focus on hardware innovation. The new Pixel devices highlight the latest in AI technology and user-friendly features. According a Bloomberg News on September 16, however, some reviews suggest they haven't surpassed competitors like Apple's iPhone.

Source: Bloomberg News Story

⚡ Mixed Reactions in the EV Market

The EV market is receiving mixed reactions. On the positive side, collaborations such as the partnership between GM and Tesla are making EV charging more accessible. Additionally, on September 16, Norway reported having more electric vehicles on the road than gasoline cars. However, according to a Bloomberg NEF report on September 18, some automakers are scaling back their previously ambitious EV targets, raising concerns about the industry’s growth pace.

Source: Bloomberg NEF, Bloomberg News Story

The GM-Tesla partnership was announced on September 18. As a result, GM electric vehicle owners now have access to more than 17,800 Tesla Superchargers in the U.S. with the use of a GM-approved adapter.

💼Amazon Announces Major Changes in Employ Management

Amazon is planning some big changes in employ management. CEO Andy Jassy is reducing the number of management layers to streamline operations and improve efficiency.

Additionally, Amazon is raising warehouse worker wages by $1.50 an hour, bringing the average base wage to over $22 an hour. To further improve employee satisfaction, they're also adding Prime subscriptions to worker benefits.

Source: Bloomberg News Story, Bloomberg First Word

That’s all for today!

If this was useful, share the post to your friends and fellow investors.